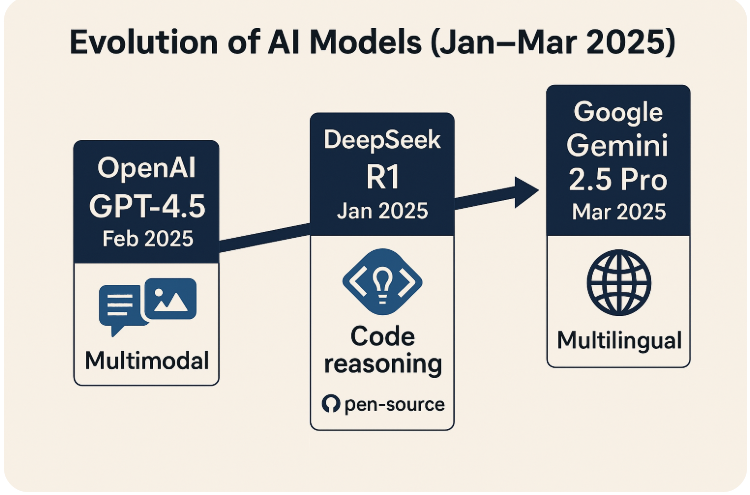

On January 27, the U.S. stock market experienced a significant downturn, primarily driven by the emergence of the Chinese AI startup DeepSeek. This event has raised questions about the competitive landscape of AI technology and the implications for U.S. tech giants.

Introduction to DeepSeek and Market Impact

DeepSeek has emerged as a formidable player in the AI sector, challenging established norms and reshaping market dynamics. The startup’s rapid rise has sparked debates about the sustainability of U.S. technological dominance. As investors and analysts scrutinize its impact, the reverberations are felt across global markets.

With its cutting-edge AI models, DeepSeek claims to deliver performance comparable to established giants like OpenAI, but at a fraction of the cost. This revelation has raised eyebrows, prompting investors to reassess their positions in tech stocks and question the viability of existing business models.

DeepSeek’s Rapid Ascent

Founded in 2023, DeepSeek quickly gained traction, primarily due to its innovative approach to AI development. The company has reportedly invested only a modest sum of approximately $5 million to $6 million in its AI models, a stark contrast to the billions spent by its competitors. This efficiency has positioned DeepSeek as a disruptive force in the industry.

DeepSeek’s flagship product, a chatbot application named DEEPseekR1, has seen explosive growth, achieving high download numbers globally. This surge in popularity has not only attracted attention from investors but has also led to service disruptions due to overwhelming demand.

Challenging U.S. Technological Dominance

The rise of DeepSeek poses a direct challenge to the prevailing dominance of U.S. technology firms. Analysts are beginning to question whether the traditional barriers to entry in the AI sector are still relevant. DeepSeek’s ability to deliver high-quality AI solutions at a lower cost undermines the narrative that significant investments are essential for success.

Furthermore, this shift in the landscape raises critical questions about the future of AI development and investment strategies. Market participants are now weighing the implications of a new player that can potentially outperform established competitors without the same financial backing.

Global Times Report on DeepSeek

Recent coverage by the Global Times highlights the strategic significance of DeepSeek’s advancements. The reports emphasize that the startup’s AI models are not only comparable to those of U.S. firms but also challenge the effectiveness of U.S. semiconductor export restrictions. This assertion, if proven true, could have profound implications for the global tech landscape.

Despite the optimism surrounding DeepSeek, skepticism remains. Many experts question the validity of the claims made regarding the performance and cost-effectiveness of its models. The lack of transparency from DeepSeek regarding its operations fuels this skepticism, leaving the market in a state of uncertainty.

Investigation into Data Misappropriation

As the excitement surrounding DeepSeek grows, so do concerns over potential data misappropriation. Reports indicate that Microsoft and OpenAI are investigating whether DeepSeek’s technology may have been developed using data obtained through improper means. This investigation could significantly impact DeepSeek’s reputation and operations.

Security researchers have suggested that individuals associated with DeepSeek may have exploited OpenAI’s API to access sensitive data unlawfully. Such actions could not only violate legal agreements but also undermine the integrity of DeepSeek’s claims regarding its AI capabilities.

As these investigations unfold, the implications for DeepSeek could be severe. If proven guilty, the startup may face legal challenges that could stall its growth and innovation. This situation highlights the thin line between competition and ethical practices in the rapidly evolving tech industry.

David Sachs’ Claims

David Sachs, a prominent figure in the tech industry, has raised serious concerns about DeepSeek’s practices. He asserts that there is substantial evidence indicating that DeepSeek has utilized outputs from OpenAI’s models as a foundation for developing its technology. This allegation, if substantiated, could have dire consequences for DeepSeek’s credibility and operational integrity.

Sachs emphasizes the importance of protecting intellectual property in the AI sector. He argues that the United States must collaborate closely with its top AI companies to safeguard their innovations against potential infringement from foreign entities.

The DeepSeek Shock on U.S. Markets

The emergence of DeepSeek has sent shockwaves through the U.S. stock market. On January 27, high-tech stocks plummeted, reflecting investor fears regarding the viability of established firms in the face of a low-cost competitor. The phenomenon dubbed the “DeepSeek Shock” raises questions about the sustainability of current market valuations.

As the market reacted to these developments, many investors began selling off shares in tech companies, fearing that their investments might be overvalued. This panic selling was particularly evident in companies heavily reliant on high-cost AI developments.

NVIDIA’s Significant Loss

NVIDIA, a leader in AI technology and semiconductor production, experienced a staggering 17% drop in its stock price. This decline resulted in a loss of nearly $590 billion in market capitalization, marking one of the largest single-day losses for a company in the tech sector. Investors are increasingly worried that the rise of DeepSeek and similar low-cost alternatives will erode NVIDIA’s market share and profitability.

The market’s reaction underscores a broader concern: If AI can be developed at a fraction of the cost, the extensive investments that companies like NVIDIA have made may not yield the expected returns. This shift in perception has led to a reevaluation of the entire tech landscape.

Market Reactions and Predictions

The market’s response to DeepSeek’s entry has been swift and severe. Analysts predict that the implications of DeepSeek’s model could lead to a fundamental shift in how investors view tech stocks. Many are now questioning whether the massive investments in AI technology are necessary or sustainable.

Some experts believe that the traditional barriers to entry in the AI market are crumbling, allowing new players to emerge and disrupt established companies. This sentiment is echoed by various market commentators who warn that the current focus on high-cost AI solutions may need to be reassessed.

The Magnificent Seven and Earnings Reports

As the market navigates this upheaval, attention is turning to the earnings reports of the so-called “Magnificent Seven” tech companies, which include Apple, Microsoft, Meta Platforms, and Tesla. These companies are expected to release their financial results soon, and traders are keenly observing how they will justify their substantial investments in AI amidst the rising competition from DeepSeek.

The upcoming earnings calls are critical as they will provide insights into how these tech giants plan to adapt to the new landscape shaped by DeepSeek. Investors are particularly interested in understanding the rationale behind their AI spending and whether these expenditures will translate into competitive advantages or merely higher costs.

Market analysts are also speculating about the potential long-term effects of DeepSeek on the tech industry. Some believe that if DeepSeek proves its claims regarding cost-effective AI development, it could lead to a paradigm shift, forcing established companies to rethink their strategies and potentially lower their prices to remain competitive.

DeepSeek’s Development Costs

DeepSeek’s reported development costs have raised eyebrows throughout the tech industry. The startup claims to have achieved significant advancements in AI with a remarkably low investment of $5 million to $6 million. This contrasts sharply with the billions spent by established tech giants on similar projects.

This discrepancy in spending has led to speculation about the sustainability of DeepSeek’s model. Many industry experts are questioning whether such low costs can genuinely support high-quality AI development. If DeepSeek’s claims hold true, it could redefine investment strategies across the sector.

Cost Breakdown and Efficiency

To understand DeepSeek’s efficiency, one must consider the potential breakdown of its costs. Key areas likely include:

- Research and Development: Minimal compared to competitors.

- Talent Acquisition: Leveraging a small, skilled team.

- Technology Utilization: Utilizing existing frameworks and open-source platforms.

Such an approach may allow DeepSeek to minimize expenses while maximizing output. However, the long-term viability of this cost structure remains uncertain.

Skepticism Surrounding DeepSeek’s Claims

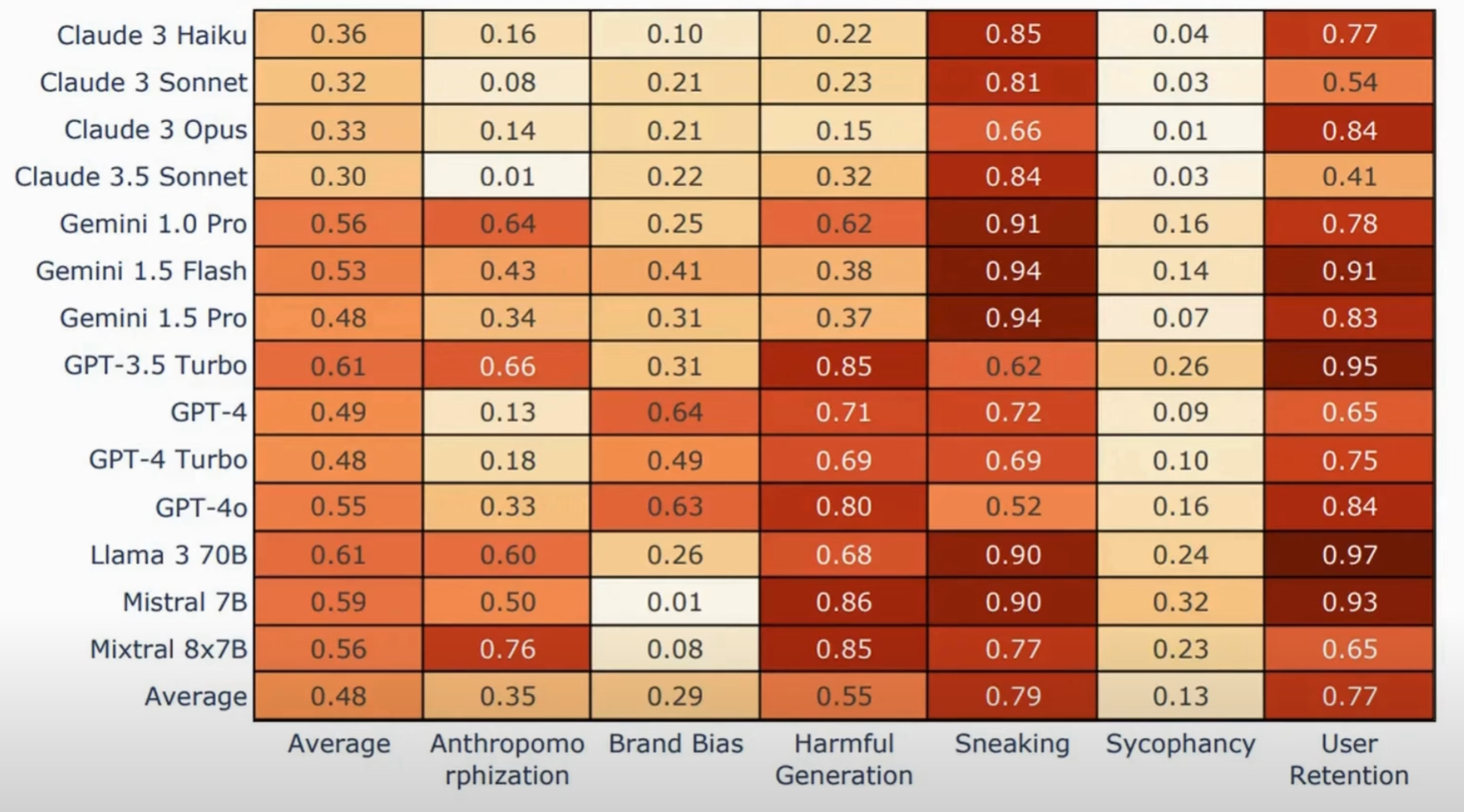

Despite the buzz surrounding DeepSeek, skepticism looms large. Industry experts express doubts about the startup’s ability to deliver on its promises. Many are wary of the lack of transparency regarding its operations and technology.

Questions arise about how DeepSeek can produce AI models comparable to those of established firms at such a low cost. Analysts argue that there may be undisclosed factors contributing to these claims, casting doubt on the trustworthiness of the information provided.

Concerns Over Transparency

Transparency is a critical factor in establishing credibility in the tech industry. DeepSeek’s reluctance to share detailed information about its processes has fueled skepticism. Key concerns include:

- The source of its data and training methods.

- Potential reliance on proprietary technologies from competitors.

- The overall impact of its AI models on user privacy and data security.

Without addressing these concerns, DeepSeek may struggle to gain the trust of investors and users alike.

Potential Barriers to Market Expansion

As DeepSeek seeks to expand its market presence, several barriers could impede its growth. One significant challenge is the regulatory environment in various countries, particularly concerning data privacy and security.

Countries like Australia have already expressed concerns about the implications of DeepSeek’s technology. These regulatory hurdles may complicate the startup’s efforts to penetrate Western markets.

Competitive Landscape

The competitive landscape also poses challenges for DeepSeek. Established firms have not only significant financial resources but also extensive experience in navigating market dynamics. Key obstacles include:

- Brand Recognition: Established companies have strong brand loyalty.

- Resource Allocation: Larger firms can allocate more resources to R&D.

- Partnerships and Ecosystems: Existing relationships with tech partners can be hard to break.

To overcome these barriers, DeepSeek will need a robust strategy that emphasizes its unique value propositions while addressing market concerns.

Future Implications for AI Development

The rise of DeepSeek signals a potential shift in AI development paradigms. If the startup can validate its claims, it may inspire a new wave of innovation focused on cost efficiency and accessibility.

Such a shift could democratize AI technology, making it more accessible to smaller businesses and startups. This change may lead to increased competition, fostering an environment ripe for innovation.

Reevaluating Investment Strategies

As the landscape evolves, investors may need to reassess their strategies. The traditional belief that high investment guarantees high returns may no longer hold true. Potential implications include:

- Increased focus on efficiency over sheer investment.

- A shift toward supporting startups that challenge established norms.

- Greater emphasis on transparency and ethical practices in AI development.

Investors will need to adapt to these changes to remain competitive in a rapidly evolving market.