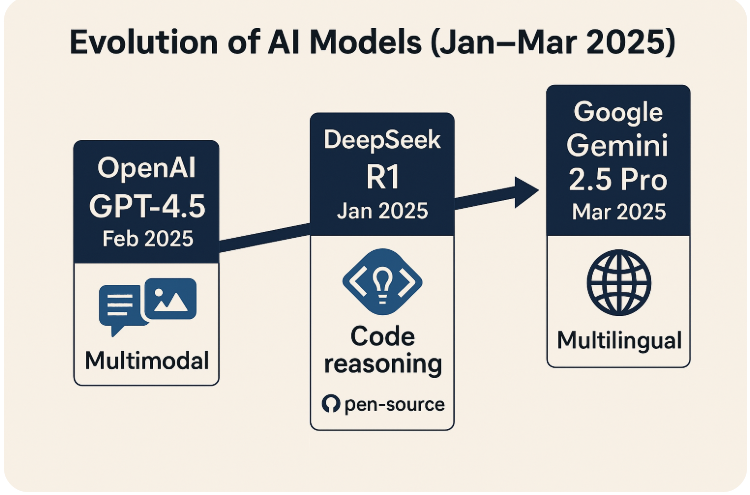

In this blog, we explore the recent developments surrounding the AI bubble, particularly focusing on the DeepSeek shock and its impact on major tech companies like NVIDIA. As the market reacts to these changes, we delve into the reasons behind the fluctuations in AI-related stock valuations and the broader implications for the tech industry.

Introduction to the AI Bubble

The AI bubble is a term that describes the rapid growth and subsequent instability of investments in artificial intelligence technologies. Much like previous technological bubbles, this phenomenon is characterized by soaring valuations, exuberant investor sentiment, and a proliferation of startups aiming to capitalize on the AI trend. However, the critical question remains: how sustainable is this growth?

As companies rush to integrate AI into their operations, the market has seen a surge in AI-related stocks. This has created a sense of urgency among investors, many of whom are eager to stake their claims in what they believe to be the next big thing. Yet, with the emergence of low-cost AI solutions, such as those developed by DeepSeek, the landscape is shifting rapidly.

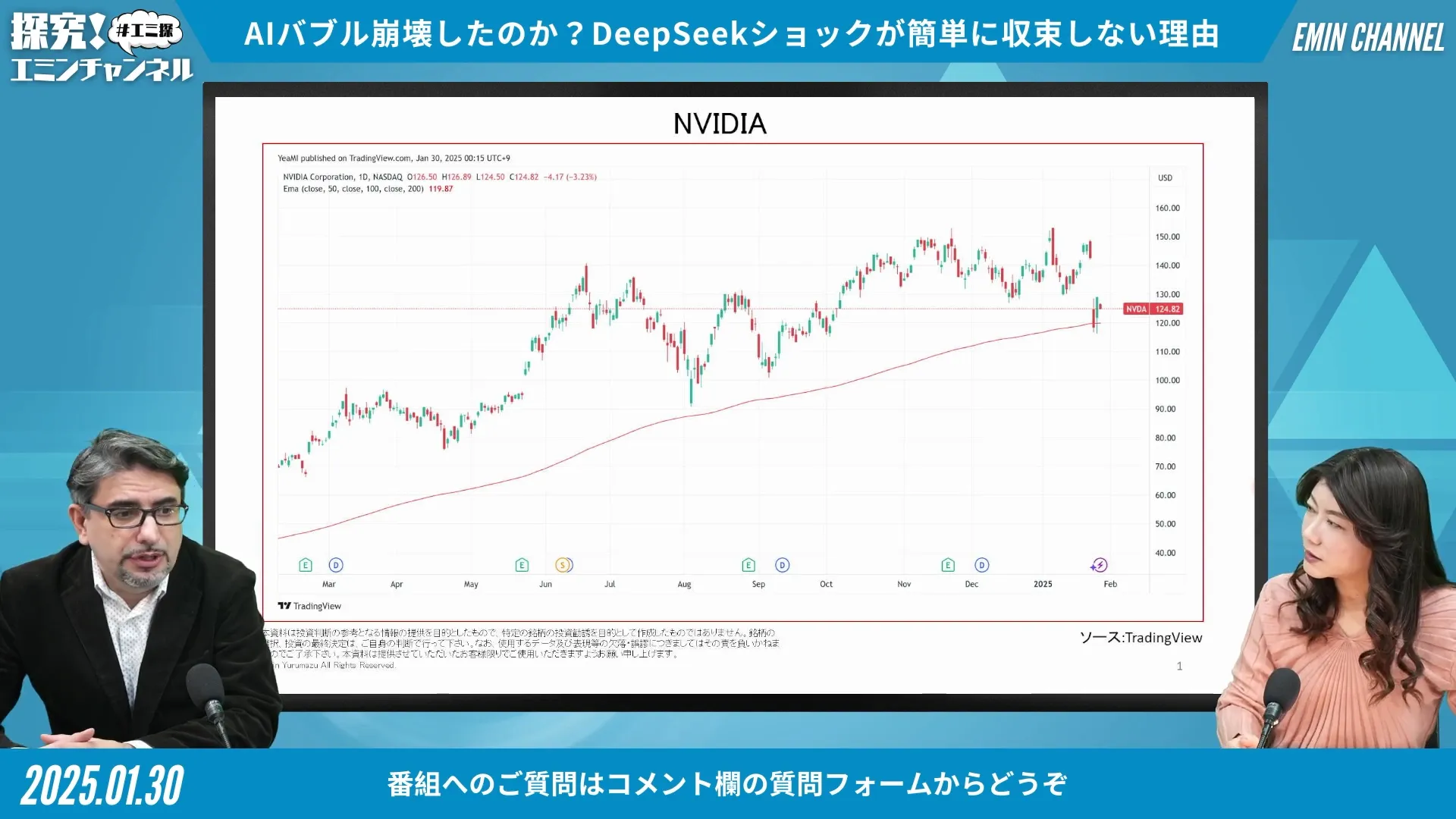

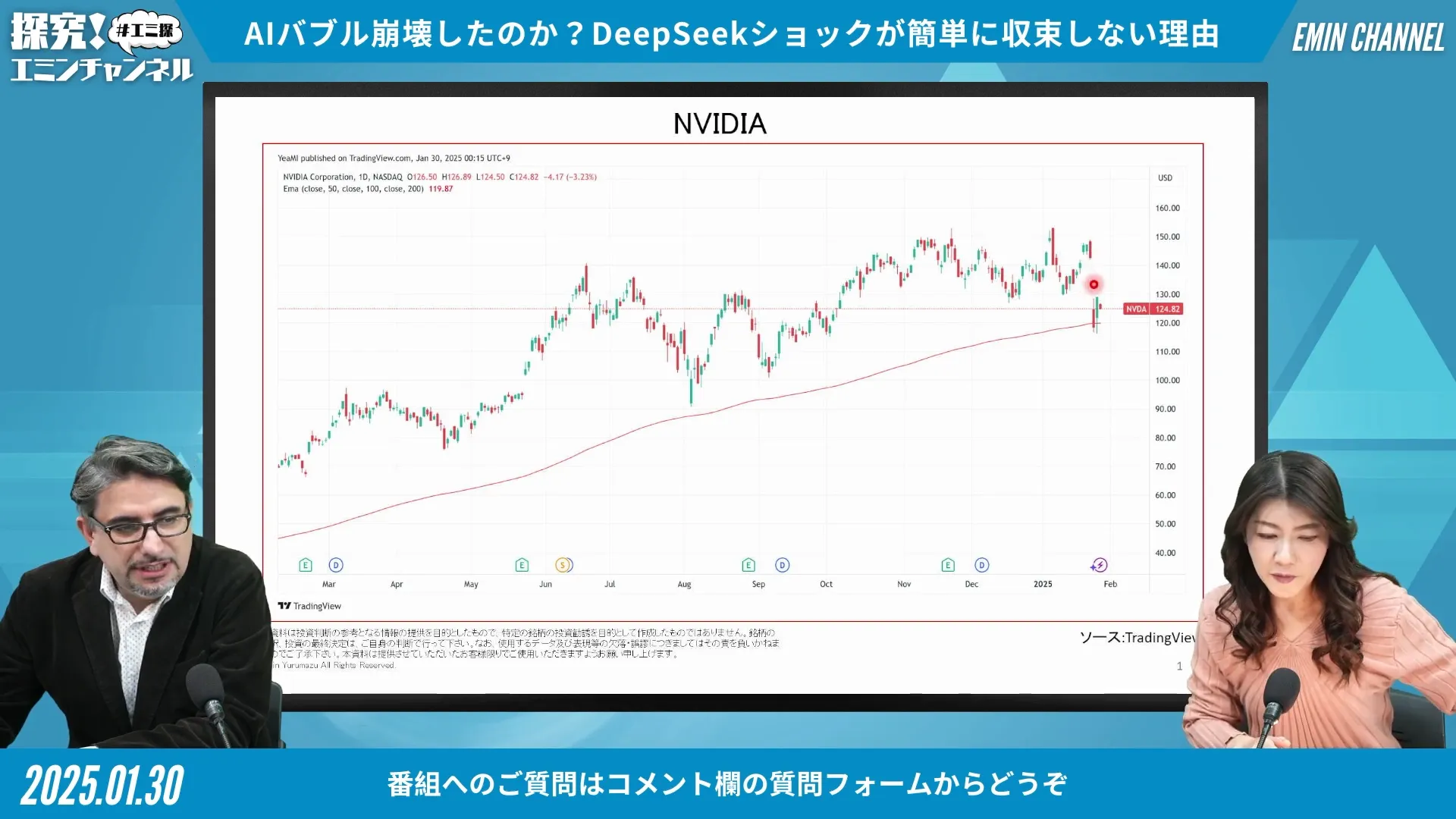

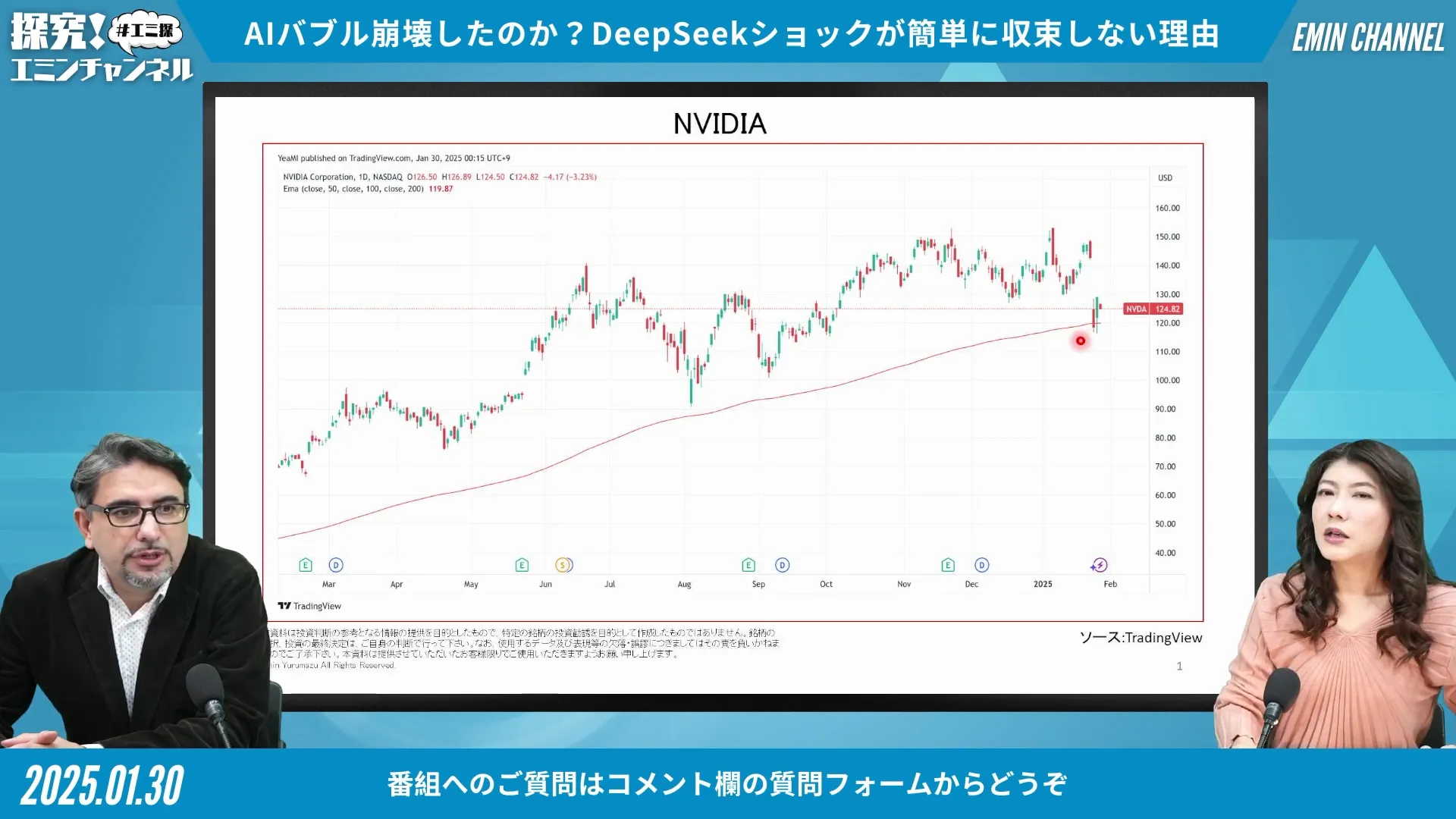

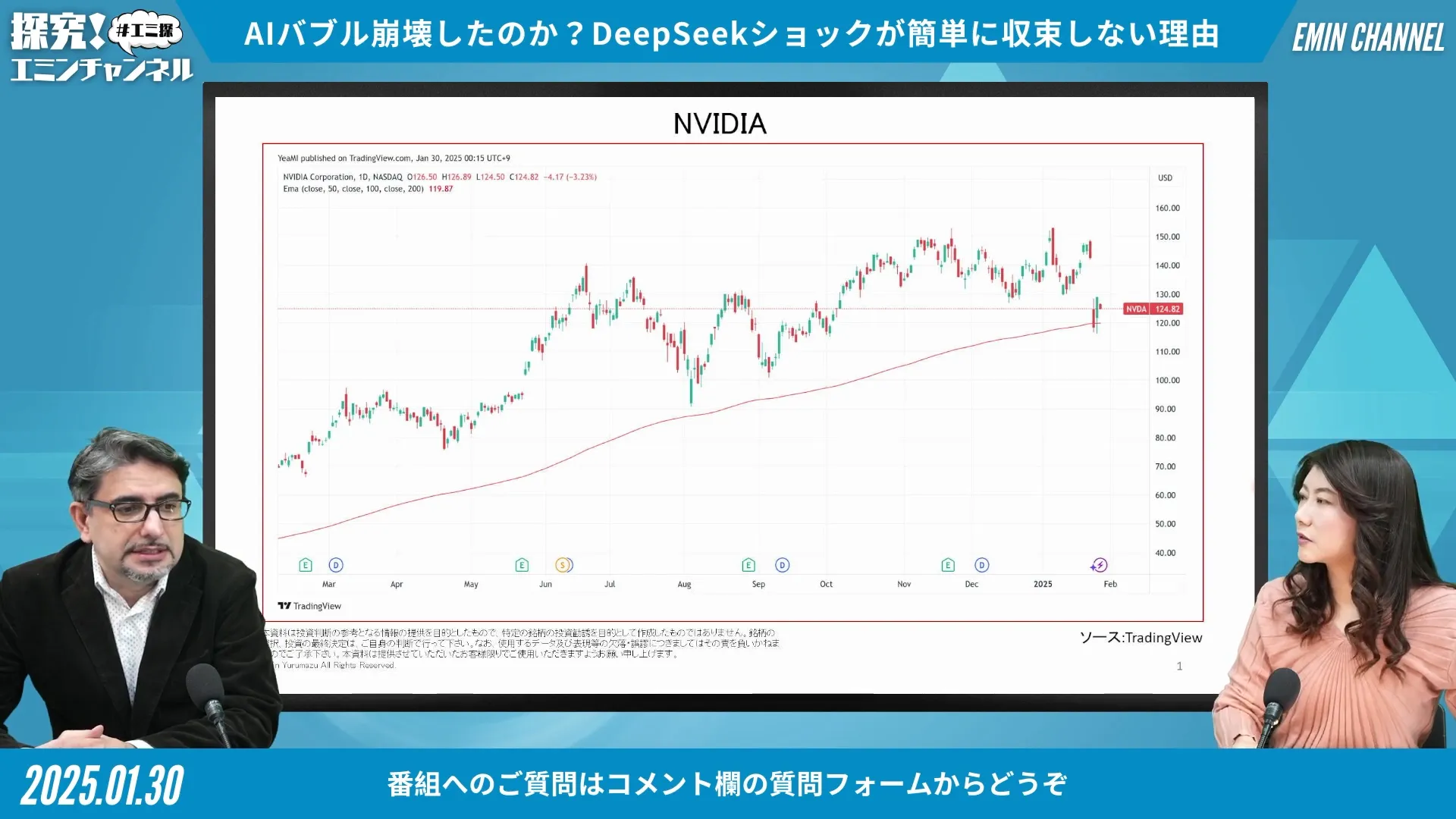

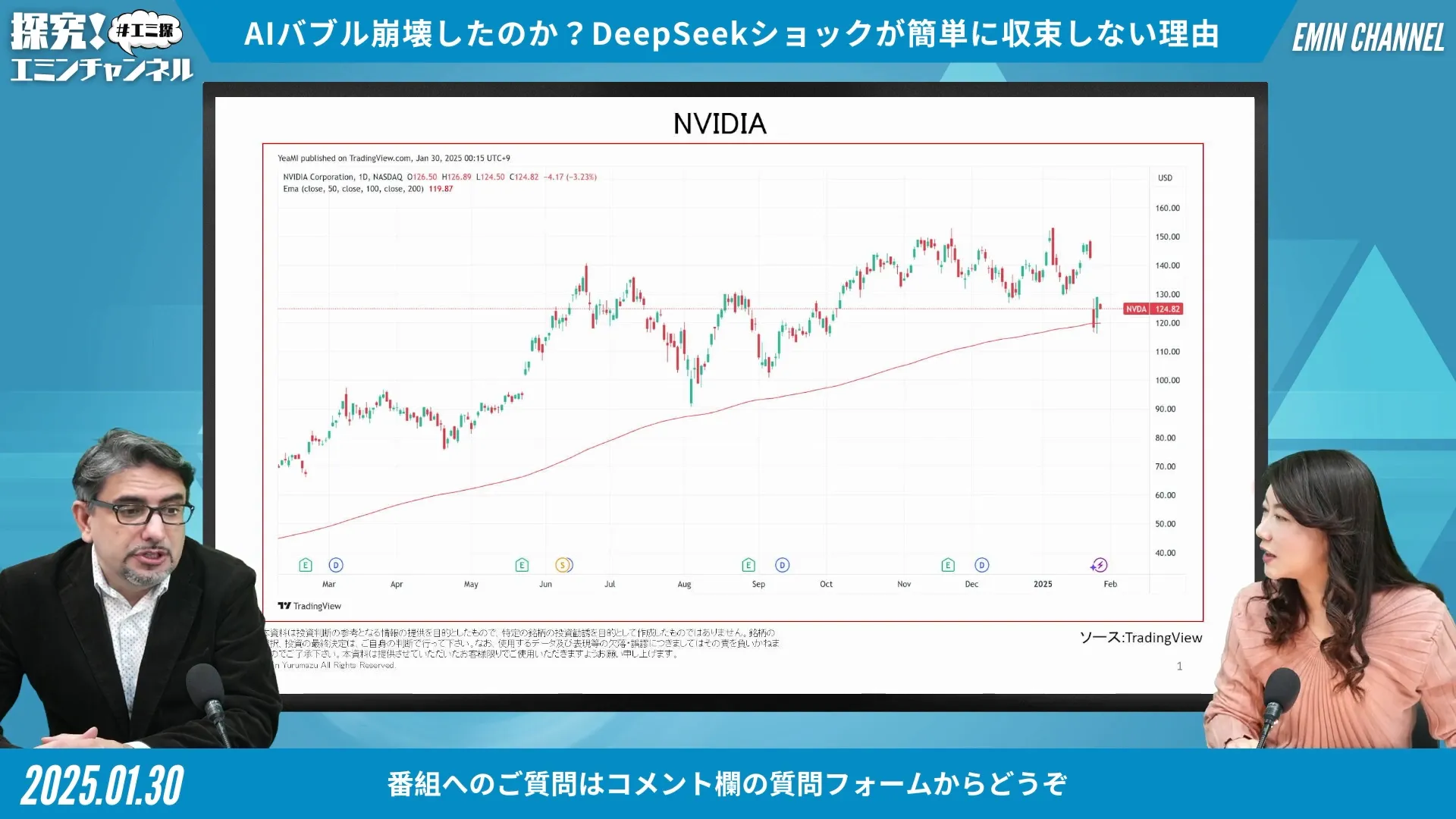

The Rise of NVIDIA

NVIDIA has emerged as a key player in the AI space, primarily due to its advanced graphics processing units (GPUs) that power AI applications. The company’s stock skyrocketed as demand for its chips surged, driven by the AI boom. Investors have viewed NVIDIA as a bellwether for the tech industry, with its performance often indicative of broader market trends.

However, the recent developments surrounding DeepSeek pose a significant challenge to NVIDIA’s dominance. As competitors introduce more affordable AI solutions, questions arise about the long-term sustainability of NVIDIA’s market position. Will its high-end chips remain essential, or will the market shift towards more accessible options?

Understanding Generative AI

Generative AI refers to algorithms that can create new content, from images to text, based on the data they have been trained on. This technology has gained immense popularity due to its ability to produce high-quality outputs at scale. Companies are increasingly leveraging generative AI for various applications, including marketing, content creation, and product design.

The rise of generative AI has democratized access to sophisticated AI tools, allowing smaller companies to compete with tech giants. This shift raises important questions about the future of AI development: will we see a move towards commoditization, where advanced AI capabilities become widely available at a fraction of the cost?

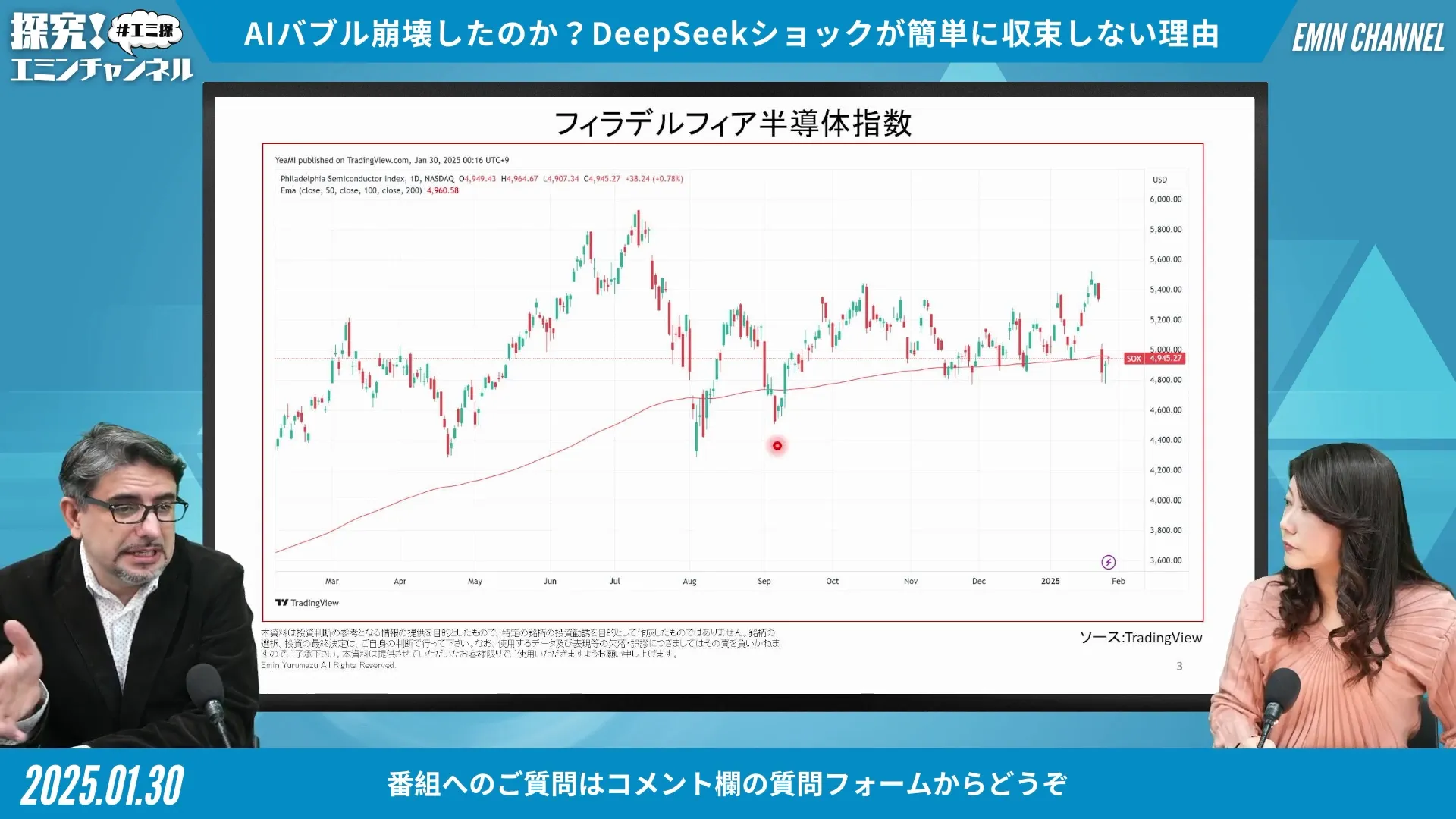

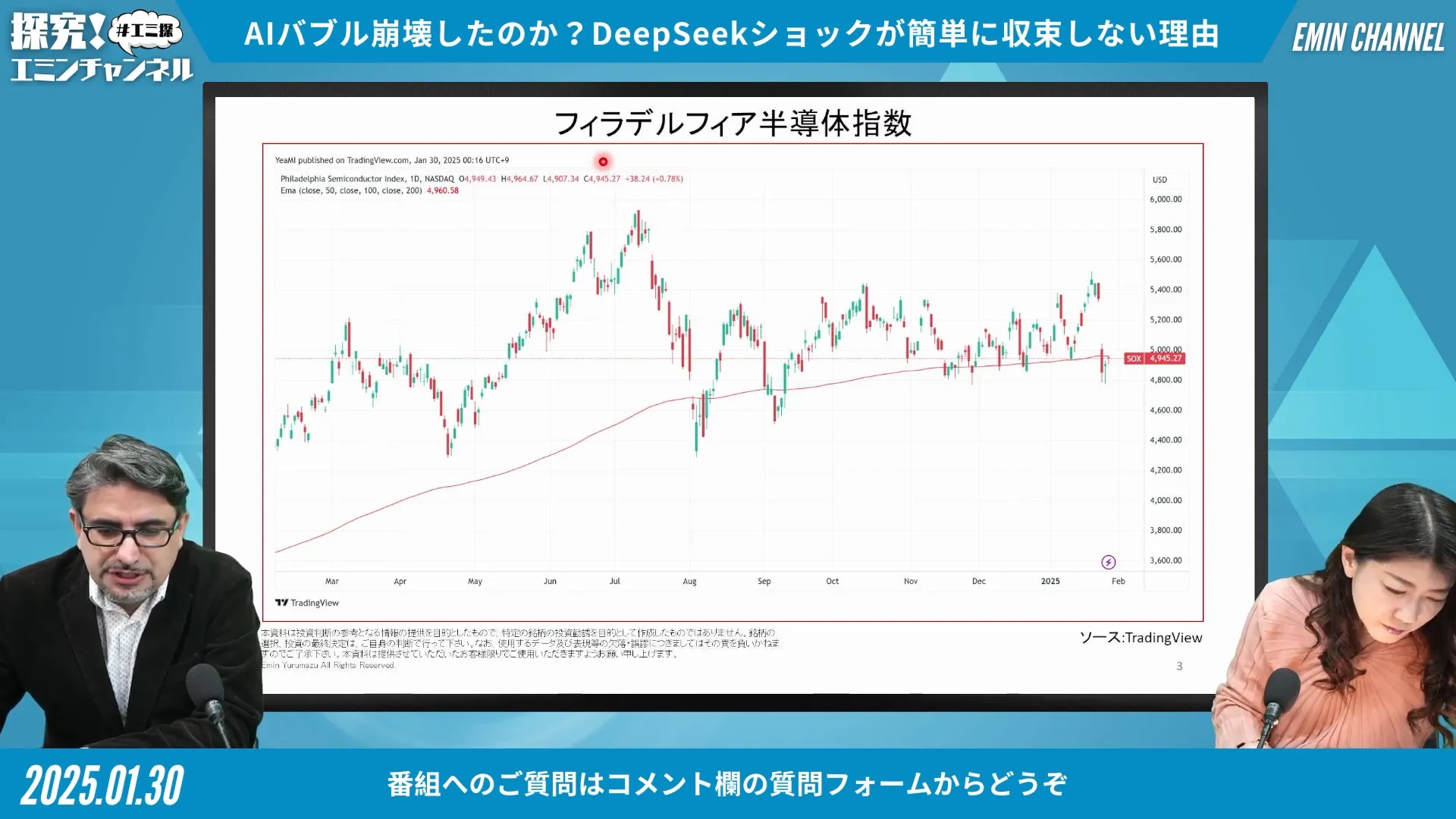

Analyzing the Philadelphia Semiconductor Index

The Philadelphia Semiconductor Index, or SOX, serves as a crucial barometer for the semiconductor industry. It reflects the performance of major semiconductor companies and provides insights into the health of the tech sector as a whole. Recent fluctuations in the SOX have drawn attention, particularly as AI investments continue to drive demand for chips.

Historically, the SOX has experienced significant volatility, mirroring the trends seen during the dot-com bubble. As AI technologies gain traction, the index could be poised for another period of rapid growth, but it also carries the risk of a sharp correction. Investors must remain vigilant and consider the broader implications of these trends on the semiconductor market.

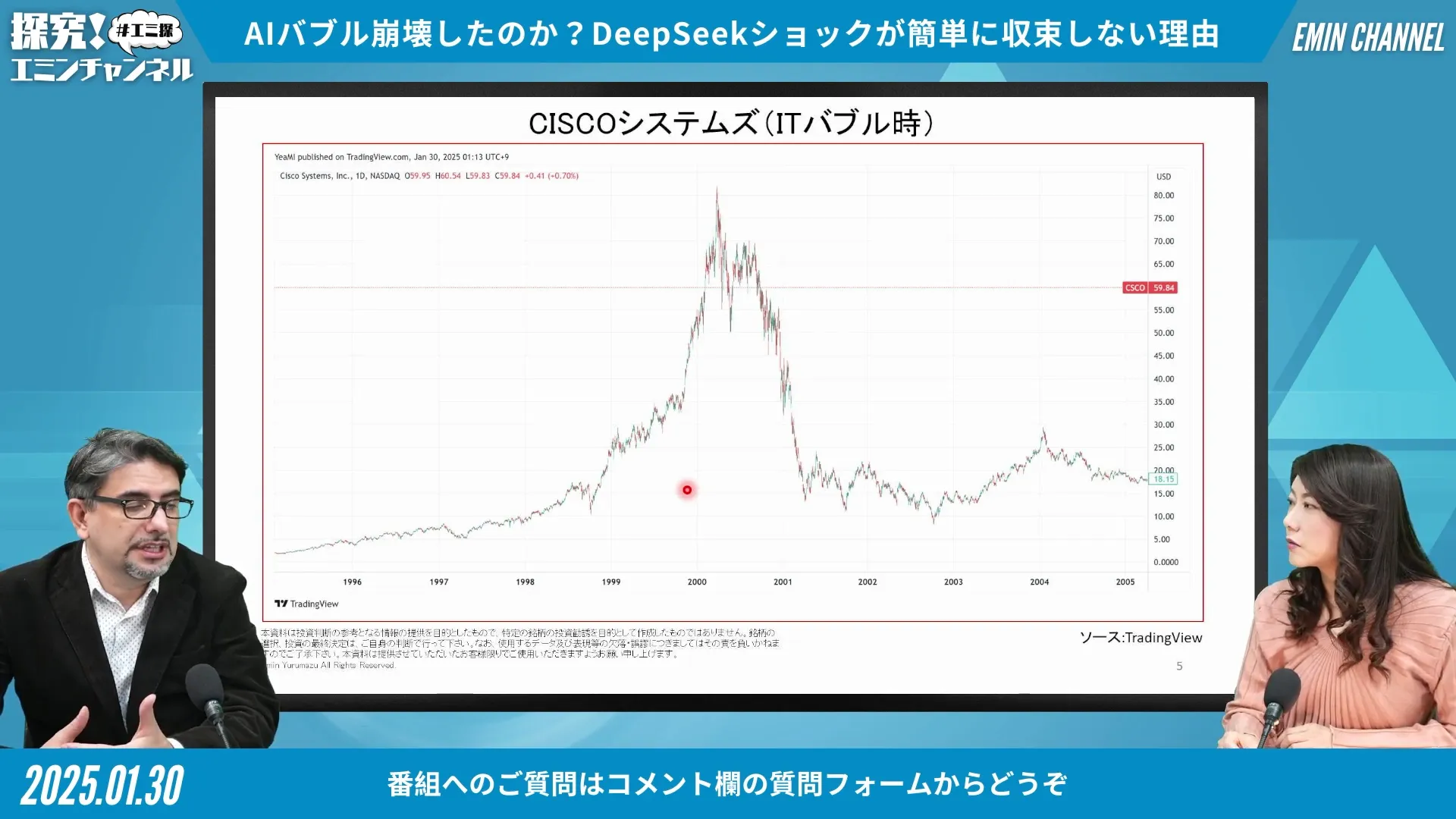

Historical Context: The IT Bubble

The IT bubble of the late 1990s serves as a cautionary tale for today’s investors. During this period, the market was flooded with tech startups, many of which had little more than a business plan. Valuations soared as investors chased the next big idea, only to see the bubble burst in the early 2000s, leading to significant financial losses.

Understanding the dynamics of the IT bubble can provide valuable lessons for navigating the current AI landscape. Key indicators such as unsustainable valuations and speculative investments can serve as warning signs for potential investors. As the AI bubble continues to evolve, it is crucial to learn from past mistakes and approach investments with caution.

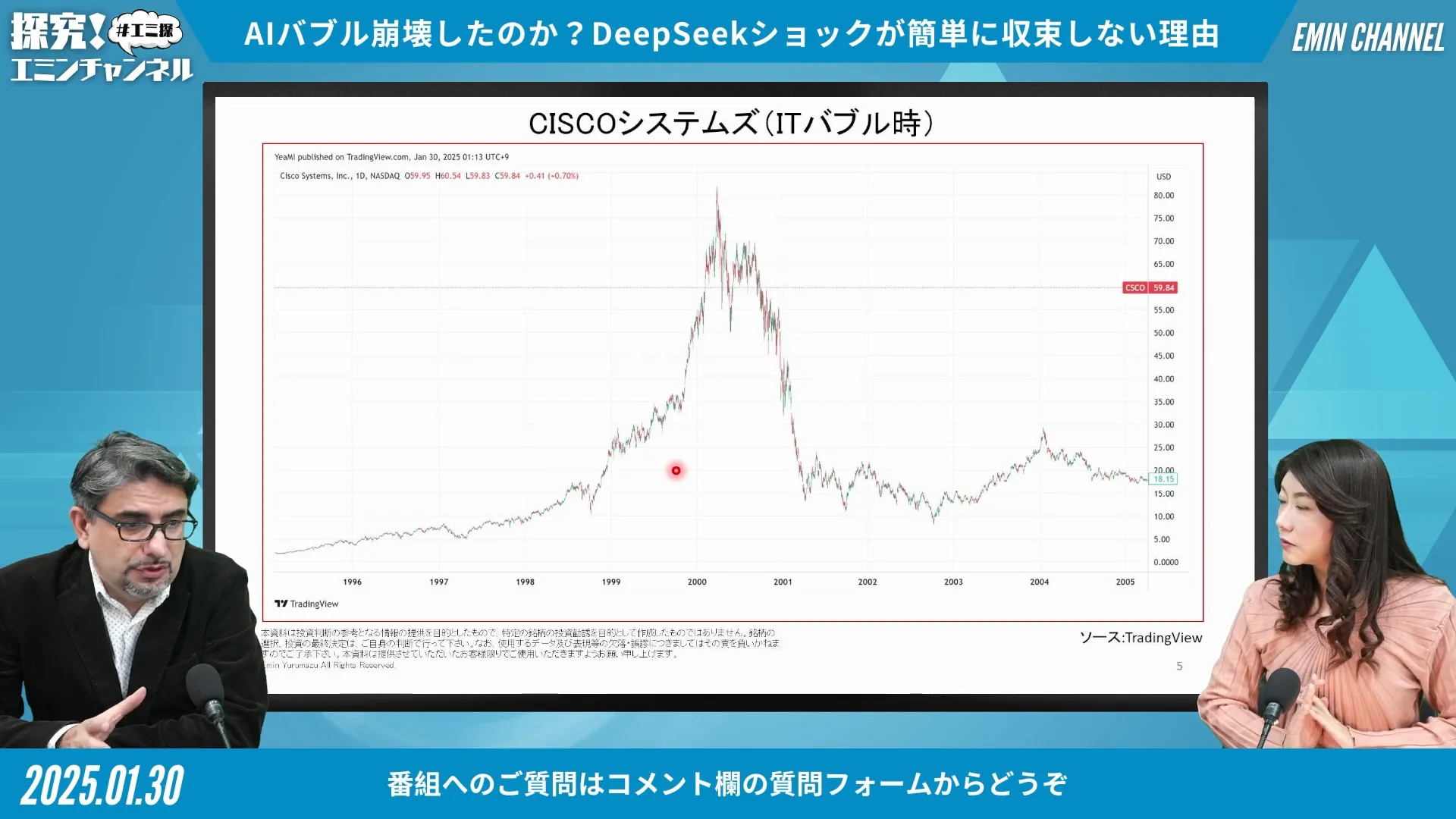

Case Study: Cisco Systems During the IT Bubble

Cisco Systems serves as a prime example of a company that thrived during the IT bubble of the late 1990s. Initially a manufacturer of routers and switches, Cisco capitalized on the rapid expansion of the internet. Investors flocked to Cisco, believing it was essential for the future of networking technology.

As the dot-com boom accelerated, Cisco’s stock price soared. At its peak, Cisco’s market cap reached over $500 billion, making it one of the most valuable companies in the world. However, when the bubble burst in 2000, Cisco’s stock fell dramatically, reflecting the unsustainable nature of its valuation.

Long-Term Trends in NVIDIA’s Stock

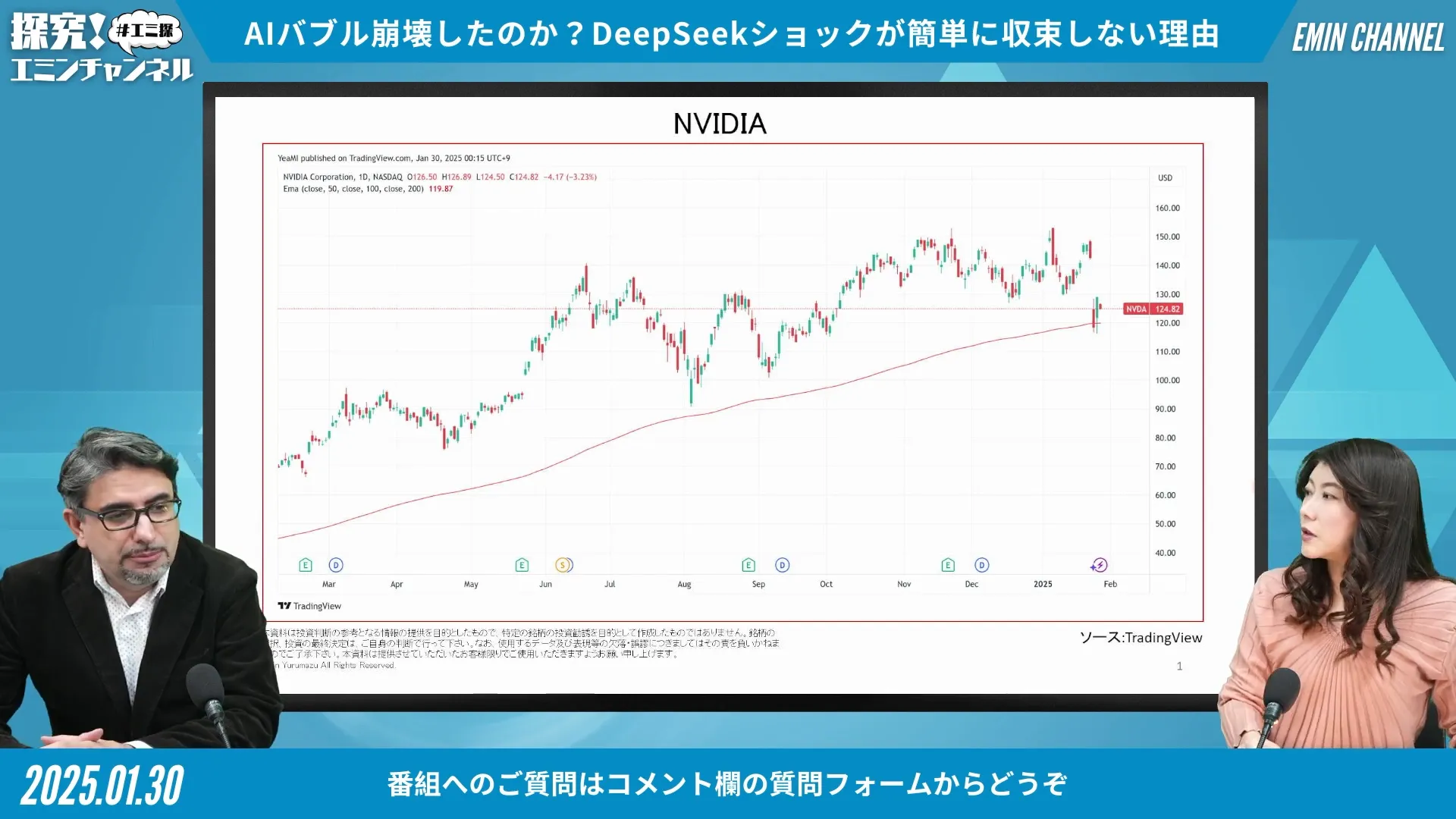

NVIDIA’s stock has shown remarkable resilience over the years, but it has also experienced significant volatility. After its meteoric rise during the AI boom, the company now faces questions about its future. Historical trends indicate that while NVIDIA’s growth was fueled by increasing demand for GPUs, the market can shift rapidly.

Investors must analyze NVIDIA’s current market position in the context of emerging competitors and potential commoditization of AI technologies. The stock’s long-term trajectory will depend on how well NVIDIA adapts to these changes and maintains its competitive edge.

The DeepSeek Shock: What Happened?

The emergence of DeepSeek has sent shockwaves through the tech industry. This new player has developed a highly competitive AI engine at a fraction of the cost that established companies like NVIDIA typically charge. With a development cost of around $600,000, DeepSeek’s model raises concerns about the sustainability of high-end AI solutions.

Investors are now questioning whether the premium prices of NVIDIA’s chips are justified. The market’s reaction has been swift, with significant sell-offs in AI-related stocks as investors recalibrate their expectations. This shift highlights the fragility of the current AI bubble and the potential for broader market corrections.

Market Reactions to AI Developments

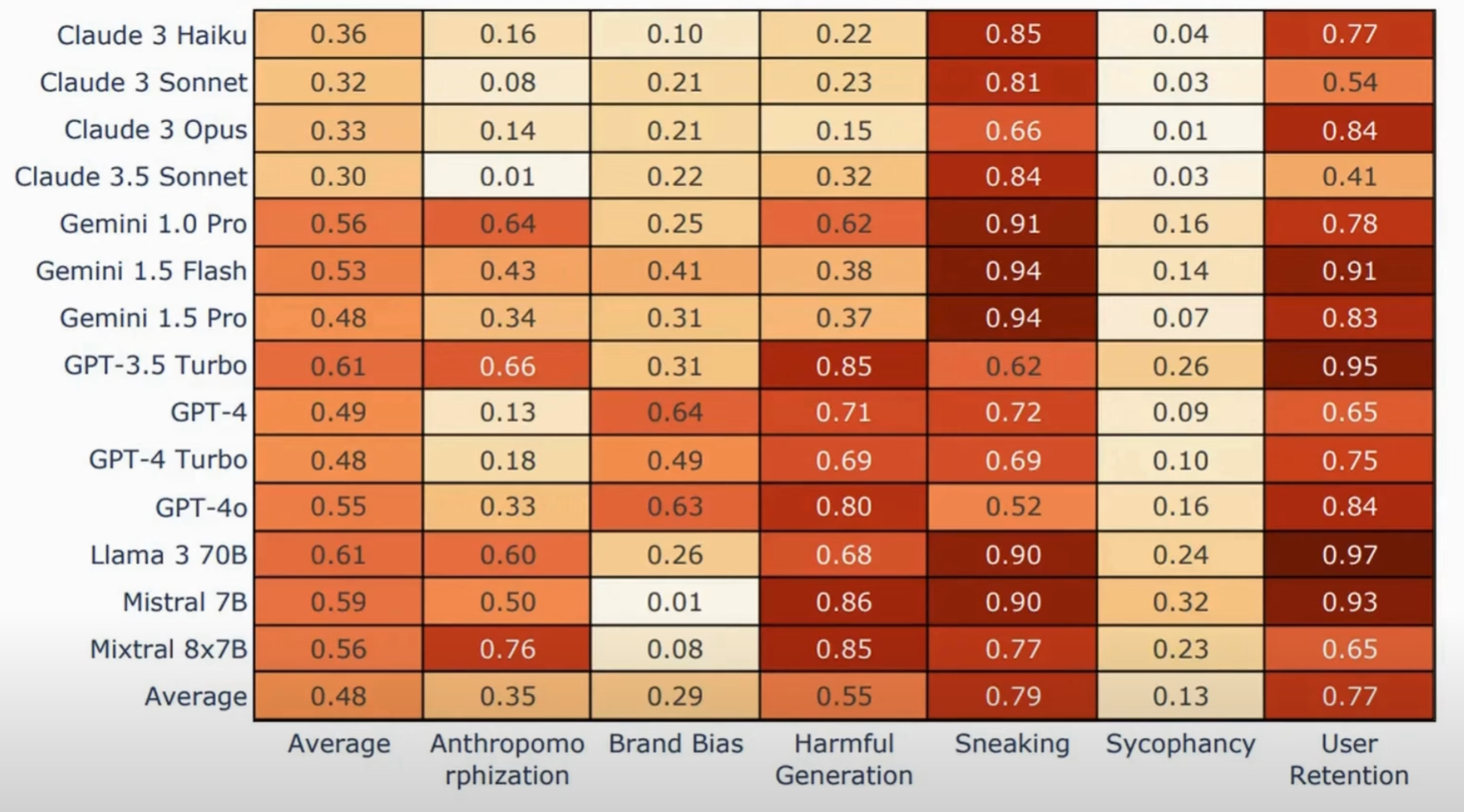

The market’s response to recent AI developments has been mixed. On one hand, there is excitement about the potential of AI technologies to revolutionize various industries. On the other hand, the rapid pace of innovation raises concerns about overvaluation and sustainability.

As companies like DeepSeek enter the market with lower-cost alternatives, established players are forced to reevaluate their strategies. This dynamic has led to increased volatility in AI stocks, with investors reacting to both positive advancements and competitive threats.

Investor Sentiment and AI Valuations

Investor sentiment is crucial in determining the valuations of AI companies. Currently, there is a sense of cautious optimism, but many are wary of the speculative nature of AI investments. As seen in previous bubbles, high valuations can lead to significant corrections when investor confidence wavers.

With the advent of more affordable AI solutions, investors are beginning to question whether current valuations reflect true market potential or speculative hype. Understanding this sentiment will be key for investors navigating the complex landscape of AI technologies.

The Importance of Scale in AI Development

Scale is a critical factor in the development of AI technologies. Companies that can leverage significant computational power and vast datasets are better positioned to create advanced AI models. This is because training AI requires not only sophisticated algorithms but also substantial resources.

Large tech companies, often referred to as GAFA (Google, Apple, Facebook, Amazon) and others like Tesla, have invested heavily in building data centers equipped with high-performance GPUs. This investment allows them to process large amounts of data efficiently, enhancing their AI capabilities.

As the market evolves, smaller companies may struggle to compete unless they find innovative ways to access similar resources. The emergence of cost-effective AI solutions, like DeepSeek, may alter the landscape, allowing for more players to enter the field.

Cost Implications of AI Technologies

The cost of developing AI technologies has significant implications for both startups and established companies. Historically, creating advanced AI systems required substantial financial investment, often relegating this capability to large corporations with deep pockets.

However, the introduction of low-cost AI solutions has changed the dynamics. DeepSeek’s ability to develop a competitive AI engine for approximately $600,000 exemplifies this shift. This affordability allows smaller firms to explore AI without the need for extensive capital.

As AI technologies become cheaper to develop, we may see a democratization of AI capabilities, enabling innovation from a broader range of companies. This could lead to increased competition and potentially disrupt the market further.

Disruption in the AI Market

The AI market is currently experiencing significant disruption, primarily driven by new entrants offering competitive technologies at lower costs. DeepSeek’s emergence is a case in point, as it challenges established players like NVIDIA, which have dominated the market with high-priced solutions.

Disruption often leads to a reevaluation of current market leaders and their strategies. Companies may need to innovate rapidly or risk losing their competitive edge to more agile competitors. This environment fosters rapid advancements in technology, but also raises questions about the sustainability of existing business models.

As AI becomes more commoditized, established companies must adapt to remain relevant. This may involve diversifying their offerings or reducing prices to compete effectively.

The Future of AI Engines and Commoditization

The future of AI engines appears to be leaning towards commoditization. As more companies develop affordable AI solutions, the landscape will likely shift from one dominated by a few major players to a more diversified market.

Commoditization can democratize access to AI technologies, allowing smaller companies and startups to leverage advanced capabilities without massive financial burdens. This shift could lead to a surge in innovation, as diverse players explore novel applications and use-cases.

However, this also poses challenges for traditional players who may find their market share eroded. They will need to rethink their strategies, focusing on value-added services rather than merely providing AI engines.

Conclusion: Navigating the AI Landscape

Navigating the evolving AI landscape requires a keen understanding of market dynamics, cost implications, and the impact of new entrants. Companies must remain agile and responsive to changes in technology and consumer demand to thrive in this competitive environment.

Investors should also be cautious, recognizing the signs of potential overvaluation as the market adjusts to new realities. The AI bubble, while promising, carries inherent risks that must be carefully evaluated.

In conclusion, the future of AI is bright but complex. As we witness the commoditization of AI technologies, the potential for innovation increases, but it is vital to approach this landscape with a strategic mindset.