What is the FICO Score Explanation Service?

The FICO Score Explanation Service is a solution designed to provide consumers, lenders, and regulatory bodies with transparent, concise, and actionable explanations for how a FICO® Score is determined. As credit scores play a critical role in lending decisions—affecting loan approvals, interest rates, and credit terms—there is a growing need for clarity around how these scores are computed. Traditional credit scoring models, though robust and standardized, can appear as “black boxes” to consumers who receive a three-digit score without understanding the drivers behind it.

FICO’s Score Explanation Service addresses this challenge by dissecting the credit score into its contributing factors and highlighting the reasons behind the score outcome. By doing so, it ensures that consumers gain trust and confidence in the credit decision-making process, lenders maintain compliance with consumer protection regulations, and other stakeholders can verify the fairness and accuracy of credit evaluations.

Key Capabilities and Architecture

- Automated Reason Codes and Score Factors:

The service automatically generates “reason codes” or “adverse action codes” that clearly state why a consumer’s score is at a certain level. These reason codes correspond to major factors such as payment history, amounts owed, credit history length, types of credit used, and new credit activity. - Model-Agnostic Integration:

Although it is tailored to FICO® Scores, the service can integrate with a variety of credit decisioning systems, loan origination platforms, and CRM tools. Its APIs allow lenders to request and retrieve explanations for any given consumer’s FICO Score in real time, embedding transparency directly into lending workflows. - Real-Time and Batch Processing:

The solution can operate in real-time for online credit applications or customer inquiries, and can also handle batch operations for large-scale compliance reporting. Scalability ensures that whether a lender needs to explain a handful of scores or thousands per day, performance and reliability remain intact. - Consumer-Friendly Language:

While technically grounded, the explanation output is designed to be easy to understand. Industry-standard reason codes are accompanied by plain-English statements, ensuring that non-technical users (consumers, call center agents) can grasp the underlying message without specialized knowledge.

Explainability, Compliance, and Trustworthy AI

- Regulatory Compliance (ECOA, FCRA):

Financial regulations, such as the U.S. Equal Credit Opportunity Act (ECOA) and Fair Credit Reporting Act (FCRA), mandate that lenders provide understandable reasons when credit is denied or when less favorable terms are offered. The FICO Score Explanation Service directly supports compliance by supplying accurate and consistent reason codes, ensuring lenders meet legal requirements and reduce the risk of regulatory penalties. - Consumer Understanding and Engagement:

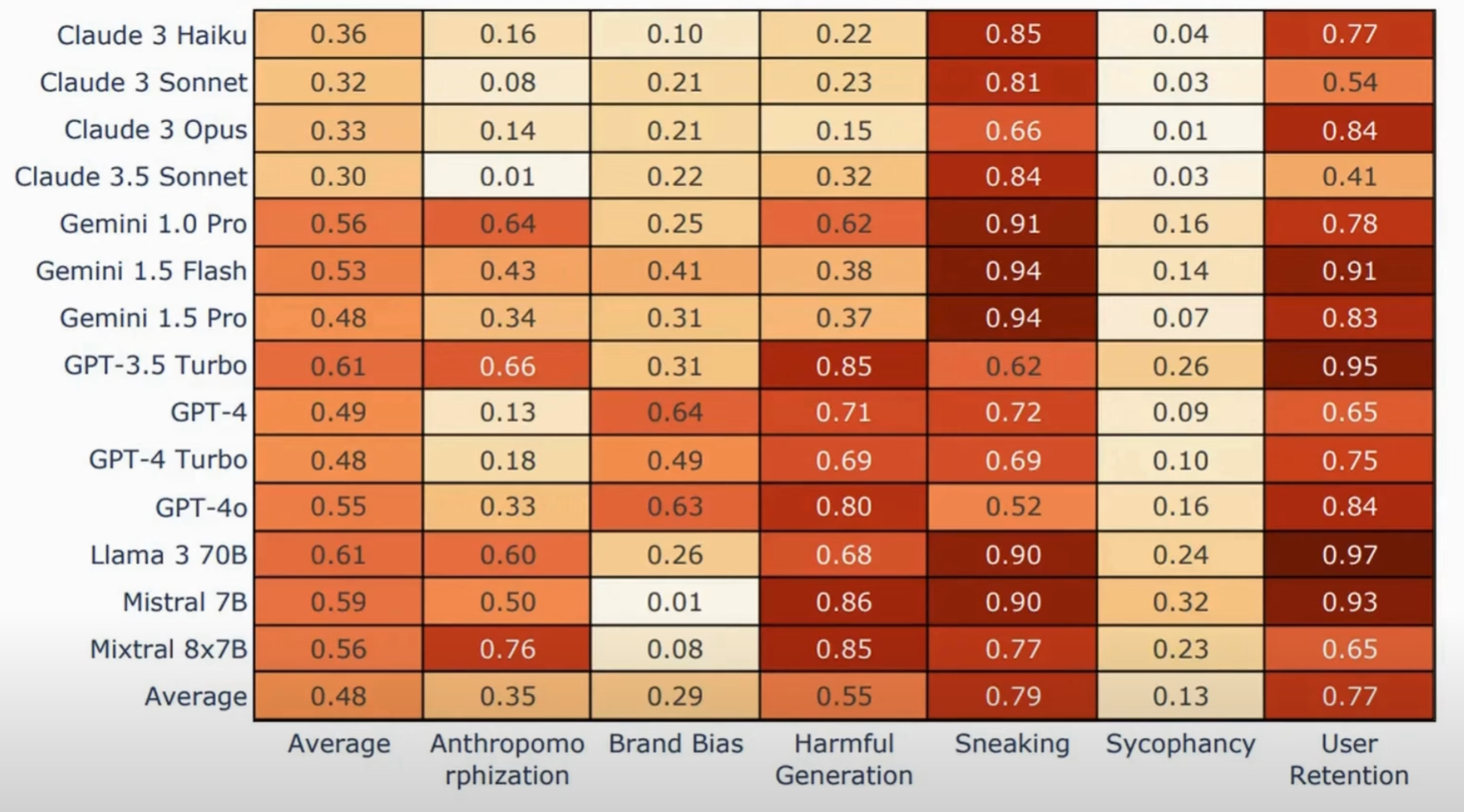

Transparency fosters trust. By showing consumers which factors most influenced their credit score (e.g., high credit utilization, recent delinquencies), the service helps them take informed steps to improve their credit health. This transparency often leads to enhanced consumer satisfaction and engagement, as customers feel empowered rather than mystified by their scores. - Fairness and Bias Mitigation:

While the service itself does not modify the underlying scoring model, offering explanations allows institutions and third parties to monitor whether certain creditworthiness factors impact protected groups more than others. This insight supports ongoing fairness assessments and can prompt lenders to reevaluate policies or data sources if unintended biases appear. - Consistent, Auditable Explanations:

By centrally managing how explanations are generated, the service ensures consistent messaging across an organization. Auditors, regulators, and internal compliance teams can verify that every consumer receives appropriate and consistent reason codes, maintaining fairness and predictability in lending decisions.

Integration within the Lending Ecosystem

- API-Driven Workflow Integration:

The service can be integrated into loan origination systems, underwriting engines, and customer service portals. With API calls, credit officers, underwriting software, or front-line service representatives can instantly retrieve explanations when a credit decision is rendered. - Partnership with Credit Bureaus and Data Providers:

FICO Scores rely on credit bureau data. The Explanation Service seamlessly works with the same underlying data sets, ensuring that the reasons reflect the consumer’s actual credit profile. Coupled with bureau data feeds, lenders maintain an up-to-date and consistent narrative around each decision. - Combining with Other Analytics Tools:

While primarily focused on credit scoring, the explanation output can be stored, visualized, or analyzed further in BI and analytics platforms. Financial institutions can use these insights to refine their credit policies, identify population-level credit trends, or improve consumer education programs. - Cloud, On-Premises, or Hybrid Deployments:

The service can be deployed in cloud-based infrastructures or integrated into on-premises environments, depending on the lender’s IT strategy and compliance requirements. Its flexible deployment options cater to organizations of all sizes and technical maturities.

Use Cases and Industry Applications

- Credit Card Issuers:

When a consumer applies for a new credit card, the bank’s decisioning system uses a FICO Score. The Explanation Service provides immediate reasons—such as “Delinquent accounts in the last 2 years” or “High balances on revolving accounts”—which can be included in a denial letter or a consumer-facing portal. - Auto and Mortgage Lenders:

Mortgage and auto loan providers can deliver explanations that detail why a borrower might not have qualified for a better interest rate. These explanations help borrowers understand what factors are impacting their loan terms, prompting possible improvements to their credit profile before reapplying. - Personal Loan and FinTech Platforms:

Online lenders and fintech companies that offer personal loans can incorporate the explanation service to enhance transparency in their often fully digital lending processes. Clear explanations build trust and reduce confusion, improving the customer experience and potentially lowering support inquiries. - Regulatory Audits and Internal Compliance Reviews:

Internal compliance teams can query historical decisions and confirm that reason codes are being generated accurately and consistently, ensuring that no hidden or arbitrary biases creep into the lending policy over time.

Business and Strategic Benefits

- Enhanced Customer Trust and Satisfaction:

By demystifying the credit scoring process, lenders can foster a relationship of trust with their customers, encouraging long-term loyalty and higher customer satisfaction levels. - Reduced Regulatory Risk:

Automatically generated, consistent explanations minimize the risk of non-compliance with consumer protection laws. This reduces the potential costs of audits, fines, or negative publicity resulting from regulatory actions. - Operational Efficiency:

Automating the generation of reason codes cuts down on manual work. Instead of case-by-case analysis, staff can rely on a standardized explanation output, streamlining internal processes and support interactions. - Data-Driven Improvement:

Aggregated explanation data helps lenders identify common reasons for credit denials or lower scores. Understanding these patterns can guide credit policy adjustments, targeted consumer education campaigns, or product design improvements.

Conclusion

The FICO Score Explanation Service bridges the gap between raw numeric credit scores and a transparent, understandable credit decision process. By providing consistent, regulatory-compliant reason codes and user-friendly explanations, this service enhances the lending ecosystem’s fairness, trustworthiness, and consumer empowerment.

With its flexible integration options, robust compliance support, and consumer-centric design, the FICO Score Explanation Service stands as a critical component in building trust in the financial industry. It ensures that every score is not just a number, but a comprehensible narrative guiding consumers toward more informed financial decisions.

Company Name: FICO

Service: FICO Score Explanation Service

URL: https://www.fico.com